With this 52 Week Saving Plan, you can painlessly save $1378 per year! Includes printables for both the original and the reverse saving plan

Welcome back to 52 Weeks to a Better You! Last week, we talked about something that seems so basic, yet so many people don't do - getting enough sleep. This week we are going to take a baby step towards improving your finances - and we are going to start doing that by establishing a simple 52 week saving plan.

This isn't going to be an amount that is going to change your life (for most people), but it will be establishing a routine of saving money and that is what this whole series is about - adopting new routines that will stick!

What would you do with $1378?

- Would you use it to save for a new car or big ticket item?

- Use it as an easy way to save for Christmas presents for next year?

- Use it to increase your Emergency Savings account?

If you have never heard of a 52 Week Money Challenge, the concept is simple. Each week you take a certain (small) amount of money and put it in savings. At the end of the year, those small amounts will add up to a nice amount!

There are 2 common approaches to a 52 Week Money Challenge and I actually prefer the "Reverse Plan" over the "Original Plan". Why? Let me explain:

The Original 52 Week Saving Plan (get your free printable to help you track your savings):

- The first week, you take $1 and place it in savings. The 2nd week, you save $2; the 3rd week you save $3...and so on until you are at the final week and savings $52 and have a grand total of $1378!

- Each week's savings is placed in a jar, envelope, or something similar. Personally, I have both my savings and checking accounts at the same bank and use online banking, so I just go in an transfer the money between accounts

The Reverse 52 Week Saving Plan (get your free printable to help you track your savings):

- The first week, you take $52 and place it in savings. The 2nd week, you save $51; the 3rd week you save $50...and so on until you are at the final week and only putting aside $1 and have a grand total of $1378!

So why do I like the Reverse Plan better? Because like many projects, we are usually more motivated in the beginning and with the Reverse Plan, we get the biggest "chunk" out of the way in the very beginning.

Even better, once you get in the habit those first few weeks of setting $45 - $50, you may find yourself not WANTING to decrease the amount you are saving each week and end up with much more than $1378 at the end of the year!

So who is with me? Are you ready to start your 52 Week Money Challenge?

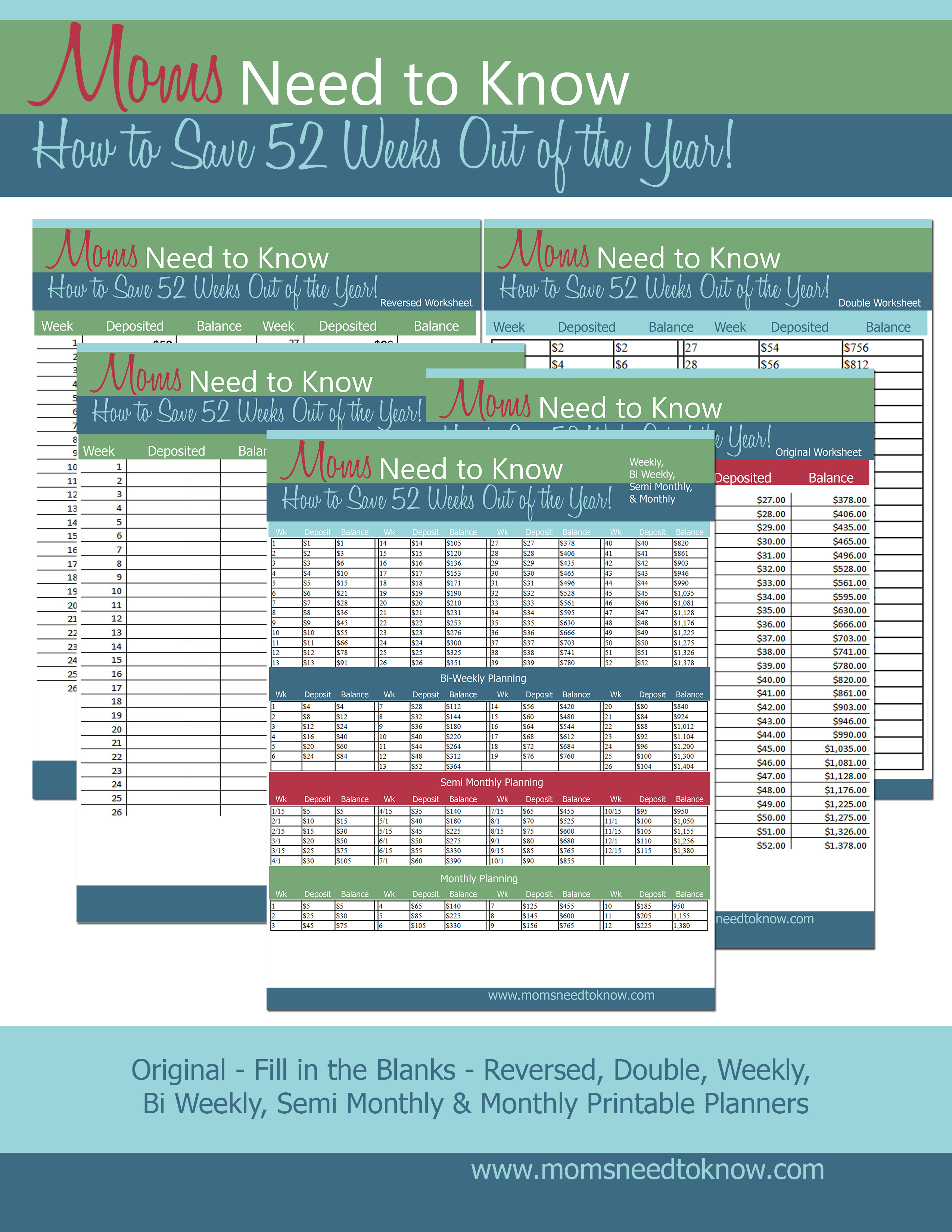

To help you along the way, I have a few FREE printables for you:

- The 52 Week Money Challenge PRINT - Original Version

- The 52 Week Money Challenge PRINT - Reverse Version

- The 52 Week Money Challenge PRINT - Blank Version (use this to record the actual amount that you put away each week)

- The 52 Week Money Challenge PRINT - Doubled Version (use this one if you want to get really serious and save twice as much each week)

- The 52 Week Money Challenge PRINT - Weekly, Bi-Weekly, Bi-Monthly and Monthly Planner (use this is you have an irregular income or don't get paid every single week)

Will you take the Challenge with me? Be sure to check back and we can all keep each other accountable!

Raquel

Great printable! I am sharing this on my FB page tomorrow morning!

Gigi

We did this last year and it made the holidays so enjoyable. Both my husband and I did it so we had plenty of money for family gifts. This year we are already three weeks into the program and our goal is to finish by the end of October. By using the reverse method, the last couple months we can really close it out with no pressure. Thanks for such an easy way to make the holidays more enjoyable.

Mindi Cherry

So glad it worked for you! It IS an easy way to save for Christmas shopping (and I prefer the reverse method as well)

Amy

I am printing off three copies of the reversed blank chart, so both of my girls can save along with me. Thanks for the variety of charts to suit all savers.